- #2019 CALIFORNIA TAX TABLE UPDATE#

- #2019 CALIFORNIA TAX TABLE CODE#

- #2019 CALIFORNIA TAX TABLE FREE#

Per Remote Seller Sales Tax Code & Common Definitions: Gross sales Per Remote Seller Sales Tax Code & Common Definitions: Previous calendar year Per Remote Seller Sales Tax Code & Common Definitions: $100,000 or 200 transactions

#2019 CALIFORNIA TAX TABLE UPDATE#

See our news update for the full list of municipalities that have adopted the code. The Alaska Remote Seller Sales Tax Commission passed its “Remote Seller Sales Tax Code & Common Definitions” that would apply to local municipalities in Alaska that choose to adopt it.

January 1 following the year the threshold is exceeded Marketplace sales excluded from the threshold for individual sellers When You Need to Register Once You Exceed the Threshold Includable Sales (Gross, Retail, or Taxable) Note on “Includable Sales”: grosssales includes all sales including sales for resale, taxable, and exempt sales retailsales do not include sales for resale taxablesales excludes any nontaxable sales regardless of reason. Click on the state name to see all of the news items we’ve published for that state. Click the links under the “More Information” column for more details about the enacted legislation. Key tenants of economic nexus rules are summarized for each state below. Economic nexus generally requires out-of-state sellers to register and collect and remit sales tax once they meet a set level of sales or number of transactions within a state.

#2019 CALIFORNIA TAX TABLE FREE#

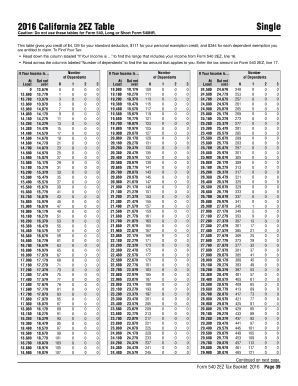

Contact us today at 81 or fill out our contact form to schedule a free consultation to get started.Every state with a sales tax has economic nexus requirements for remote out-of-state sellers following the 2018 South Dakota v. Our Los Angeles accountants can help guide you in the right direction in every aspect of your tax preparation, in addition to other financial services that you need. The chart below shows how this computation is made. You will also be taxed by a marginal percentage for any amount you made above your highest bracket. For example, if you are earning $150,000, you will be taxed for the brackets between $ 0.00 and $8,223.00 all the way up to %53,980.00 and $275,738.00. California Single Tax Brackets Tax BracketĬalifornia Married Tax Brackets Tax BracketĬalifornia has a progressive taxation method, which means that you don’t have just one tax bracket, but you every bracket that applies to your income. The following brackets have been in effect since April 2019. In 2017, the “Tax Cuts and Jobs Act” overhauled the tax income through sweeping changes made to the tax code, which many consider the largest changes that have been made in 30 years.

0 kommentar(er)

0 kommentar(er)